Alright folks, buckle up! Because something seriously interesting is happening in the Ethereum markets, and it's got all the hallmarks of a launchpad moment. We're talking about a potential springboard for the next big bull run, and I, for one, am absolutely buzzing with excitement!

The headline? Ethereum just saw a massive $359 million spot outflow, the third-largest since October. Now, on the surface, that might sound like a cause for concern, right? But dig a little deeper, and you'll find a much more compelling story. This isn't a fire sale; it's a strategic accumulation. It's dip-buying on a grand scale, a signal that savvy investors are loading up on ETH while the price is down. And historically, that is where the magic happens.

Echoes of the Past, Visions of the Future

Think about it: people are moving their Ethereum off exchanges and into private wallets. That isn's casual, that is a statement of intent. It's like saying, "I'm not selling anytime soon." And when you see that kind of conviction, especially after a price dip, it's a pretty strong indicator that something's about to shift. Remember those outflows back in October? The ones that preceded price surges of 13% and 7.9%? Yeah, that's what I'm talking about!

And it's not just historical data that's fueling my optimism. The recent sell-off also liquidated a ton of leveraged long positions—$325 million worth, to be exact. That's a flush of leverage, a clearing of the decks, if you will, that often paves the way for a bullish reversal. It’s like a coiled spring being released; the energy has to go somewhere, and in this case, it's likely to propel Ethereum upward.

Shivam Thakral, CEO of BuyUcoin, gets it. He told Decrypt that this outflow "could point to renewed accumulation or dip buying," signaling growing confidence and long-term holding intent. And when you combine that with Ethereum's historically strong year-end seasonality... well, let's just say things could get very interesting, very quickly. According to Ethereum Traders Buy the Dip Despite Third-Largest Spot Outflow Since October, this outflow could signal renewed accumulation.

But let's not get ahead of ourselves too much. As Thakral also wisely pointed out, broader macro risks still exist. Rate cut-induced volatility, geopolitical uncertainty... these are all factors that could throw a wrench in the works. Global liquidity conditions will ultimately be the deciding factor. But with the U.S.-China trade war temporarily on pause, a major overhang for risk assets has been lifted.

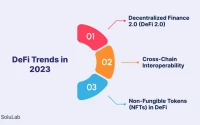

It’s like we are standing at the edge of a new frontier, where the potential for growth and innovation is immense. What if the next generation of decentralized applications, the next wave of DeFi protocols, are built on this foundation? What if this dip-buying signal is the starting gun for a new era of Ethereum dominance?

Of course, with great power comes great responsibility. As we move forward, we need to be mindful of the ethical implications of this technology. How do we ensure that it's used for good, that it benefits all of humanity, and not just a select few? It's a question we need to be asking ourselves constantly.

I saw a comment on Reddit the other day that really resonated with me. Someone wrote, "Ethereum is the internet of value. It's not just about money; it's about creating a more open, transparent, and equitable world." And that, my friends, is the kind of vision that gets me truly excited.

The Dawn of a New Era

So, what's the real takeaway here? This isn't just about a potential price bounce. It's about the long-term potential of Ethereum, the unwavering belief of its community, and the transformative power of decentralized technology. It's about a future where finance is more accessible, where data is more secure, and where opportunity is more evenly distributed. And if that's not something to be excited about, I don't know what is!