Deconstructing the Economic Engine

At first glance, the Uniswap Proposes Sweeping ‘UNIfication’ With UNI Burn and Protocol Fee Overhaul reads like a shareholder's dream. Activating protocol fees, a long-debated topic, is finally on the table. A portion of these fees, along with revenue from the Unichain L2, will be funneled into a UNI burn mechanism. This is classic supply constraint economics, designed to create deflationary pressure and, theoretically, increase the value of the remaining tokens. It’s a clean, logical financial maneuver.

But the proposal goes further, introducing a retroactive burn of 100 million UNI tokens from the treasury. The stated rationale is to compensate for the fees that would have been burned had the switch been active since launch. I've looked at hundreds of corporate filings and shareholder proposals, and this particular move is unusual. It feels less like a technical adjustment and more like a dramatic, headline-grabbing gesture. It's financial theater designed to signal a radical shift. Burning 100 million tokens isn't just about tokenomics; it's a permanent alteration of the protocol's capital structure. Why this specific number, and why now? Does this grand gesture serve to sweeten a deal that concentrates power elsewhere?

The proposal is a complex machine with interlocking gears. Protocol Fee Discount Auctions aim to internalize MEV, and Uniswap v4's new "hooks" will turn it into an on-chain aggregator, pulling in fees from external sources. The entire structure is being re-engineered to capture value from every possible angle and channel it back to the protocol (and by extension, UNI holders). This is being paired with a proposed annual growth budget of 20 million UNI, or to be more exact, a budget starting in 2026 and distributed quarterly. It’s an aggressive, comprehensive overhaul. The entire system is being re-plumbed to function like a ruthlessly efficient, cash-flow-positive corporation. The question is, who sits in the CEO’s chair?

The Consolidation of Power

This brings us to the core of the proposal, the part that has little to do with token burns and everything to do with operational control. Uniswap Labs, the primary for-profit development company, is set to absorb the Uniswap Foundation’s ecosystem teams. This isn't a partnership; it's a consolidation. The new, unified entity will be overseen by a five-member board (Hayden Adams, Devin Walsh, Ken Ng, Callil Capuozzo, and Hart Lambur). Suddenly, the decentralized and somewhat sprawling ecosystem has a clear C-suite.

To facilitate this, Uniswap Labs is pivoting away from monetizing its own products. The fees on its popular interface, wallet, and API will be set to zero. The official line is that this will drive "more high quality volume and integrations." While that’s certainly a plausible outcome, it also serves another, more critical purpose: it removes any conflict of interest between the protocol and its chief steward. By making Labs’ products free, the new entity can claim its sole focus is protocol growth, funded by the protocol's treasury. Its financial success is now perfectly aligned with the success of UNI.

This is where the analogy of a corporate restructuring becomes unavoidable. Imagine a large conglomerate with several competing divisions. To streamline operations, the parent company merges the most critical divisions, spins off or shutters the rest, and installs a new board to oversee the core business. That is precisely what is happening here, just wrapped in the language of Web3 governance. A five-person board is now the de facto strategic command for the ecosystem's most important development resources. How does the DAO effectively challenge a unified vision presented by the very founders and key architects of the protocol, who now operate as a single, treasury-funded entity?

The Illusion of Decentralization

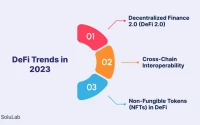

Let's be clear: this proposal is likely a strategically sound move for Uniswap's long-term survival and competitiveness. The Wild West days of DeFi are over, and protocols now compete on efficiency, user experience, and cohesive strategy. A fragmented, slow-moving governance model is a liability. The "UNIfication" proposal solves this by creating a nimble, centralized core tasked with execution, funded directly by the protocol it serves.

But we must call it what it is. This is not a bold leap toward further decentralization. It is a pragmatic consolidation of power. The economic benefits for UNI holders—the fee switch, the burn—are the incentives offered to the "shareholders" (the DAO) to approve a fundamental shift in corporate governance. By centralizing its key development and strategic teams under a single board, Uniswap is trading a degree of chaotic, decentralized purity for focused, corporate-style efficiency. It may be the right trade to make, but no one should be under the illusion that this is anything other than a quiet, carefully engineered centralization of control.