Generated Title: Aster Trade's Wild Ride: Is This DEX a Flash in the Pan, or the Future of Finance?

Alright, let's talk about Aster Trade. The DeFi space is awash with hype, and Aster's been riding that wave hard. We're seeing headlines about massive volume, partnerships, and analysts predicting all-time highs. But as a recovering data analyst, I've learned to be wary of anything that looks too good. So, let's dig into the numbers and see what's really going on.

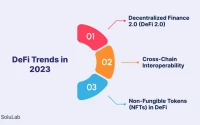

Decoding the DEX Boom

First, the headline numbers: $262 billion in perpetual DEX volume in October 2025, putting them right behind Hyperliquid and Lighter. That's a serious flex, and it's fueled by a broader surge in decentralized exchange volume – a record $1.2 trillion that month. But volume alone doesn't tell the whole story. The question is, what’s driving this volume? Is it real users, or something else entirely?

The elephant in the room is wash trading. It's the open secret of the crypto world, where bots rapidly buy and sell to inflate volume numbers. Now, I'm not saying Aster is definitely doing this, but the whispers are there, and it's something we need to consider. The key is open interest (OI), which represents the actual capital committed to the platform. While Aster boasts impressive volume, Hyperliquid still dominates in OI. This discrepancy (Hyperliquid’s OI surpasses all other perp DEXs combined) suggests that Aster might be attracting more speculative, short-term activity rather than long-term capital.

Binance's Bet and ASTER's Tokenomics

The narrative around Aster is also intertwined with Binance. Liquid Capital's founder, Jack Yi, has called Aster Binance's "second growth curve," and there's support from figures like YZi Labs Chairman Changpeng Zhao. On the Binance Smart Chain (BSC), Aster holds a respectable sixth place in total value locked (TVL) with $531.4 million. This is a good sign. But, let’s be honest, TVL isn’t the be-all and end-all.

What about the ASTER token itself? Aster DEX recently announced that ASTER tokens can now be used as collateral for perpetual trading, with an 80% margin ratio, and also be used to pay trading fees with a 5% discount. This upgrade is significant because it transforms ASTER from a purely speculative asset into one with functional utility inside the exchange ecosystem. But here's where things get interesting. After the upgrade announcement, the token slid roughly 45% in a corrective drop. That's not exactly a ringing endorsement from the market. According to analysts, this plunge flagged risks tied to high speculative demand rather than organic utility. So, while the upgrade added real utility, the market still responded with caution, hence the sharp move. (See: Aster Trade: Token Slides 45% After DEX Utility Upgrade Announcement). The token’s recent partnership with Alchemy Pay to expand global fiat access to the DeFi ecosystem is, on paper, another positive. It allows users to buy ASTER tokens directly using debit cards, digital wallets, or bank transfers. This could potentially onboard a new wave of users who find traditional crypto exchanges too complicated.

I've looked at hundreds of these token announcements, and while these partnerships are nice PR, they don't always translate into sustainable growth.

Reading the Tea Leaves

So, what does all this mean? Aster is undoubtedly making waves. The platform's rapid growth and innovative features like the "Rocket Launch" (designed to support early-stage crypto projects) are attracting attention. But there are also red flags. The concerns about wash trading, the volatile price action of the ASTER token, and the reliance on speculative hype all suggest that Aster's long-term success is far from guaranteed.

It's also crucial to note the broader context of the DeFi market. The increasing institutionalization of DeFi, driven by tighter regulations around centralized exchanges, is creating opportunities for decentralized platforms like Aster. Stablecoins are playing a critical role in this shift, acting as a bridge between traditional finance and DeFi. In October alone, stablecoin transfers on Ethereum generated between 65% and 70% of all on-chain protocol revenue. This underscores the growing importance of stable, reliable digital assets for both traders and protocols.

Questionable Numbers, Uncertain Future

Aster Trade has some serious momentum, but it's operating in a hyper-competitive and often shady environment. The inflated volume numbers, the airdrop-driven price spikes, and the general air of "get rich quick" speculation make me skeptical. While the technology and the vision might be there, the execution needs to be much more transparent and sustainable.