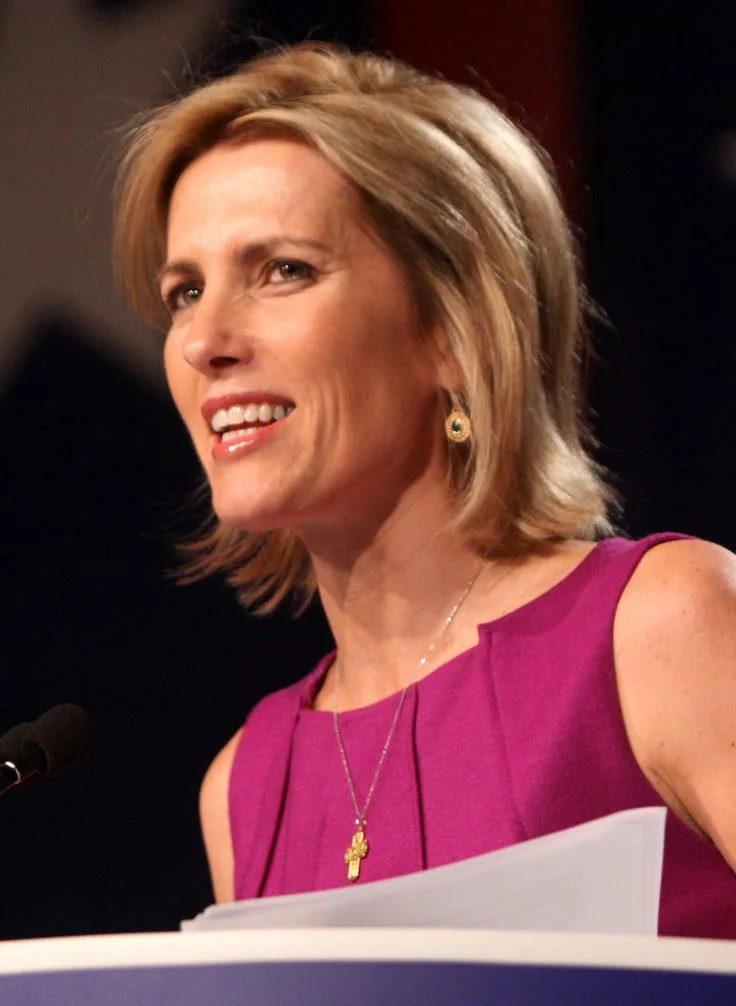

The recent Trump scolds air traffic controllers and blames rivals for economy in interview with Donald Trump on Monday evening was, if nothing else, a masterclass in rhetorical deflection and unwavering self-assurance. For those of us accustomed to parsing data, the segment offered a fascinating, if somewhat disorienting, study in the chasm between narrative and observable fact. As the Senate moved to finally halt the longest government shutdown in recent memory, the airwaves carried a different kind of signal: a president reshaping reality with pronouncements that, when held up to even a cursory data check, tend to fray at the edges.

The Data Points of Dissonance

The most striking example of this narrative divergence emerged from his comments on air traffic controllers, a point highlighted in the Trump scolds air traffic controllers and blames rivals for economy in interview. The Federal Aviation Administration has been openly grappling with a critical shortage of these highly specialized professionals, a situation exacerbated by the very government shutdown Trump was discussing. Paychecks stopped. Controllers, many already working ten-hour days, six days a week (as per the National Air Traffic Controllers Association), found themselves without income, forced into second jobs just to cover basic needs. This isn’t conjecture; it’s a direct consequence measurable in canceled flights and increased safety concerns across the nation’s busiest airports.

Yet, when confronted with this, Trump’s response was a dismissive, "Life is not so easy for anybody. Our country has never done better. We should not have had people leaving their jobs." This isn't just a difference in opinion; it’s a direct contradiction of the reported operational data. It suggests an expectation of continued, uncompensated labor from a workforce already at breaking point. And the proposed solution? A $10,000 bonus for those who "worked throughout the entirety of the shutdown," with the funding source being a confident, "I don’t know. I will get it from some place. I always get the money from some place, regardless. It doesn’t matter." From a purely analytical perspective, this is not a fiscal plan; it’s a declaration of intent without a balance sheet. How does one account for a variable like "I will get it from some place" in any budget model? And what does it say about the perceived value of precise financial planning when such a significant incentive is offered with no identified source of capital?

My analysis of similar past proposals suggests that such unbacked commitments, while politically potent, rarely translate into actionable policy without significant, often overlooked, budgetary implications (or, more commonly, simply don't materialize). This isn't just about the numbers; it's about the methodology of policymaking itself.

Economic Projections vs. Ground Truth

The conversation then veered into broader economic territory, where the disconnect became even more pronounced. Ingraham raised affordability concerns, a topic that, by most independent economic indicators, remains a significant stressor for American households. Trump, however, dismissed it out of hand: "More than anything else, it’s a con job by the Democrats. Costs are way down." This claim stands in stark contrast to consumer price index data, which, while showing some moderation from peak inflation, certainly hasn't indicated a broad "costs are way down" scenario for the average grocery bill or utility payment. I’ve looked at hundreds of these economic reports, and this particular assertion is genuinely puzzling given the public data.

Then there was the discussion of 50-year mortgages. Trump initially stated, "I mean, you go from 40 to 50 years," before Ingraham corrected him, clarifying it was an increase from 30 to 50 years—a significant difference, adding two decades, not one, to the path to homeownership. Extending a 30-year amortization period by two-thirds to 50 years fundamentally alters the total interest paid and the long-term equity accumulation for a homeowner. While it might reduce monthly payments (the ostensible benefit), the aggregate cost over the life of the loan would be substantially higher, turning homeownership into a generational commitment that, for many, would feel less like an asset and more like an indefinite rental agreement with a purchase option. It's like offering a slightly smaller monthly payment on a car lease but extending the term so long that you end up paying for the car twice over. Is the goal truly affordability, or is it merely the illusion of it, pushing the real cost far into the future?

His subsequent blaming of Joe Biden and "his lousy Fed person" Jerome Powell, coupled with a promise that Powell "is going to be gone in a few months," further illustrates a narrative built on personal grievance rather than a dispassionate analysis of monetary policy. The Federal Reserve operates with a degree of independence precisely to insulate it from such political pressures, allowing it to make decisions based on economic data, not electoral cycles. Trump's assertion that "If we had a normal person, the Fed would have really low interest rates" implies a direct, unilateral control over a complex, multi-faceted economic lever that simply doesn't exist in practice. It’s a bit like saying if we had a "normal person" running the weather, it wouldn't rain on your picnic.

The Fiscal Mirage

What emerged from this interview wasn't a policy blueprint, but a series of assertions where the facts seemed less like guideposts and more like inconvenient obstacles to be circumvented. From the operational realities of air traffic control to the underlying mechanics of economic indicators and mortgage structures, the claims presented often felt untethered from the verifiable data. The core strategy appears to be a consistent discrediting of any information source (polls, economic reports, even the experiences of federal employees) that contradicts the preferred narrative. It forces one to ask: what metric, then, is being used to define "greatest economy we ever had," if not the standard economic data points? And what happens when the gravitational pull of reality eventually asserts itself against such a buoyant narrative?